Spotify in Nigeria: Exciting times and an evaluation of arrival, purpose and direction

)

On February 23, 2021, the world’s largest streaming service announced that it had launched in Africa’s largest economy and the world’s most populous black nation, Nigeria. At the same time, Spotify also launched in 84 other countries across the world including Ghana, Kenya, Tanzania and Uganda.

Phiona Okumu, formerly Artist Relations Manager, Africa became Head of Music, Sub-Saharan Africa with Claudius Boller as Managing Director, Middle East and Africa at Spotify. This followed similar entrances into Africa by streaming platforms like Audiomack and TIDAL.

With its entrance, Spotify becomes the 13th streaming-esque platform in Nigeria alongside Apple Music, Boomplay, Audiomack, YouTube Music, YouTube Main, Deezer, Mdundo, UduX, Gbedu, MusicTime, Mino by NotJustOk and more in a streaming war that has only just begun.

Why was Spotify away for so long?

A few Nigerians have been using Spotify in Nigeria through a VPN..

It was the second streaming service in Nigeria after Deezer became the first notable entrance into Nigeria in 2012. A large part of Sub-Saharan Africa wasn’t ready for streaming.

Nigeria is a poverty capital of the world where the average person lives below $1-a-day. Yet access to the internet was ridiculously costly for Nigerians. Even though internet penetration hit around 62% in Africa in 2020 according to GetdotAfrica Newsletter, it’s still some way off the global benchmark of around 75%. You can imagine what it was like in previous years.

In 2021, People’s Gazette still reported that Nigerians have to work 27 minutes 55 seconds to afford 1 GB of mobile internet against the global average of 10 minutes. Ergo, Nigeria has the least affordable internet in the world. Although, GetDotAfrica has argued that such unwanted distinction belongs to Senegal.

As such, the more savvy and richer Nigerians would download music from blogs - who grew in power and influence. As of 2019, Mdundo CEO, Martin Nielsen and his people analysed that over 150 million Africans downloaded music over the five years preceding that and around half of that came from Nigeria.

Despite loving music, most Nigerians would consume music from cable TV, CDs, Bluetooth transfers and USB transfers. That wasn’t exactly a conducive environment for Spotify’s pricing.

Outside Nigeria and Africa, Spotify’s cheaper student plan costs $4.99 or while its main plan costs $9.99. Even before the rise of exchange rates, that was too steep for Nigerians, who mostly lived offline and watched their music videos through cable television channels and not YouTube Main.

The streaming model is also at loggerhead with consumer behaviour in Nigeria. People who are used to purchasing CDs for NGN100 and downloading or transferring through bluetooth or USB wouldn’t suddenly transition into purchasing expensive data and paying heavy prices for streaming when they can’t even eat.

Even those who can afford to pay these prices have a case of entitlement. As much as streaming has been growing in Nigeria, Boomplay and Apple Music - the biggest platforms on the market - couldn’t even boast of 500,000, in total Nigerian subscribers as at the end of 2020.

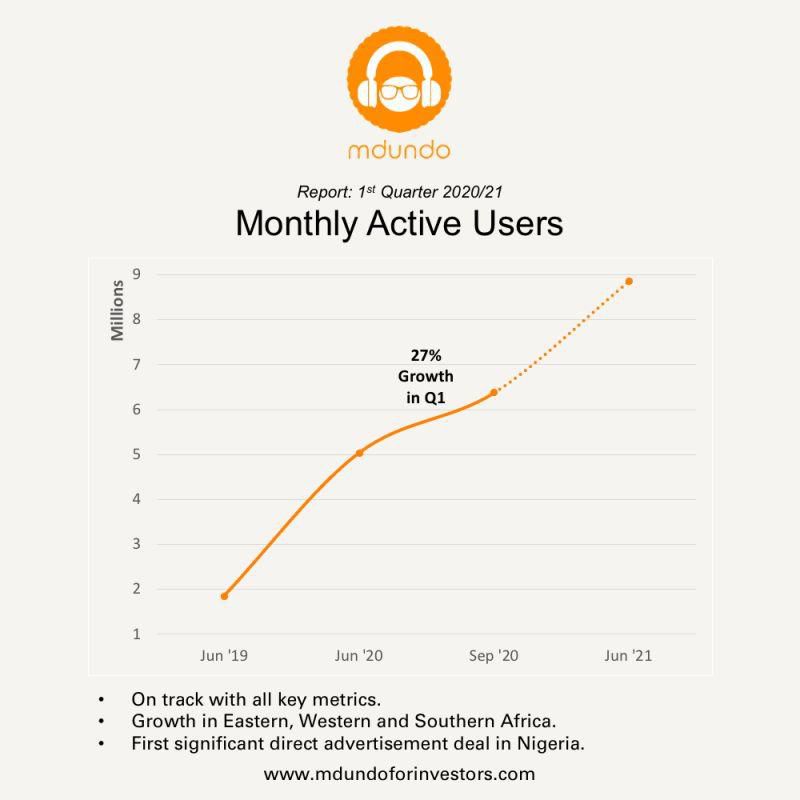

On the other hand, Mdundo, a download platform continues to grow while Naijaloaded, West Africa’s biggest download platform boasted over two billion page views in 2020 alone. In 2018, the same platform boasted over 1.8 billion unique views.

Even worse, Spotify was confronted by a legal constraint that prevented market operators from operating in dollars, in Nigeria. Ergo, if Spotify would be in Nigeria, they would have to operate in Naira and take their value out in Naira and against the dollar, the most powerful currency in the world.

Still, Nigerians would use Spotify through VPNs while IJGB Nigerians, who owned foreign bank accounts also had access.

Why is Spotify here now?

Spotify is here because over the past few years, Africa has grown.

Phiona Okumu tells Pulse Nigeria that, “Africa has become the continent with the youngest population across the world. Internet penetration is also growing fast across the continent.”

She is right, consumer behaviour continues to evolve due to the size of Africa’s young population who are attuned to internet culture with high tech savvy. That young demography has also not been fully integrated into the entitled consumer behaviour and a culture of non-payment. They also grew up with paywalls and can be converted.

This means behemoths in global capitalism are getting more interested in Africa. The cumulative successes of download platforms means internet access is growing exponentially and Facebook’s investments into African internet could mean that internet access could be cheaper in Africa over the next five years.

These days, it’s not just Paystack that’s getting good news. Every week, African startups raise sizable amounts of funds from foreign investors. Just last week, South African agri-tech startup Skudu; Nigerian foodtech startup VeggieVictory and Ghanaian ed-tech startup SFAN all raised funds. In the entertainment industry, the investors and global players are storming the market en masse.

Following the entrance of most of the streaming platforms and distributors/label services companies in the 2010s, the 2020s have already witnessed the entrance of TIDAL, Spotify and Tunecore with more on the way.

Moreover, Apple Music, Boomplay, YouTube and Audiomack continue to make forays and inventive inroads into the market, with unique customer acquisitions models. In 2020, Amazon Music became the cheapest and most popular streaming platform in the US. Thus, Spotify couldn’t afford to simply stay put and do nothing as the competition grows.

From a growth standpoint, Spotify’s expansion is perfectly-timed. In Q4 2020, Spotify reported free cash flow of €74m, total monthly active user growth of 27% to 345m. Premium Subscribers grew 24% and the Spotify Wrapped campaign got 90 million users engaged with more than 50m shares while Spotify also recorded 2.2m podcasts and 60m songs.

The freemium models of Boomplay, YouTube Main, YouTube Music and Audiomack also offer incredible food for thought. Moreover, the best competition hasn’t even reached 250,000 subscribers yet. Thus, Spotify would still be an early entrant into the African/Nigerian music streaming wars.

Spotify has also created a payment network with Nigerian banks and accepted to operate in Naira and take their revenue out of the country in Naira.

Product Review: Operation and Customer Acquisition Strategy

a.) Pricing

Spotify slashed its prices in African and commands similar fees to Apple Music and YouTube Music. Spotify offers NGN900 for individual plans, N1,400 for family plans and N450 for student plans.

In 2020, Listen Africa wrote about Spotify’s mooted ‘beta’ plans, with reduced features and reduced data consumption while offering premium features. In response, Spotify launched Spotify Lite, as a response to Africa’s expensive and slow internet.

Okumu tells Pulse Nigeria that, “Spotify’s customer acquisition strategy is to offer our famed and highly reliable global service at affordable and competitive rates while offering an alternative called Spotify Lite. We also bring our might of playlists, our renowned fast-learning, AI-enabled app behaviour and a system that sees over 400,000 uploads every week.”

Like Apple Music, Spotify offers student plans at NGN50 shorter. Unlike Apple Music and like Audiomack, Boomplay and YouTube [Main/Music], Spotify has a freemium plan.

b.) Smooth UI/UX

Spotify is famed for its impressive UI and impressive AI-backed operations. Honestly, it's everything that was promised and more. In a few days of use, Spotify has adapted incredibly to my daily listening habits. After five days, I realized that it evaluated what I'd listened to and organized by music in order of perceived interests.

Its recommendations have also been mighty impressive and so have its playlists. It feels like Spotify has a playlist for everything from mood, to themes, to genres, to subgenres, countries, continents, on-demand listenership and even lifestyle.

c.) Sound quality

However, its audio quality - both on freemium and premium - needs a little work.

Several reports have claimed that at maximum streaming quality, Spotify’s audio stands at 320Kbps. That’s quite low compared to Deezer at 1,411kbps, Tidal Hi-Fi at 9,216kbps and Apple Music at 1,233kbps.

Spotify is set to launch a Hi-Fi cadre to its subscription in some markets, later in 2021. It's also said that the Hi-Fi cadre will cost more than that $9.99. Apple is also set to do same later in the year.

d.) Integration strategy vs. the competition

While Okumu states that Spotify aims to appeal to the entire Nigerian and African market through a path of systemic growth, the overall strategy of the company is yet unclear.

Okumu did mention that Spotify will look to create content - presumably editorial, audio and visual, however.

Editorial content has aided Audiomack’s growing brand equity since the turn of 2020 while Apple Music’s editorial might is growing.

Apple Music also made major strides in the audio and visual content direction with its deal with Cool FM while Audiomack did a deal with Beat FM. But the overall strategy of Boomplay and Apple Music might define Africa’s streaming wars to a large extent.

Apple Music and Boomplay are simply products of their parent companies; Transsion and Apple, which are lifestyle brands. While Apple Music, an appliance manufacturer appeals to the premium market and controls under 2% of the Nigerian phone market, Transsion controls over 60% of the African phone market with targeted features like longer battery life, to cope with Africa’s electricity issues.

This is what Spotify is up against.

The continued rapid growth of Amazon Music in the US shows that 360 digital companies that have high penetration on a product level have higher customer acquisition potential on music streaming. It’s also no coincidence that Apple Music and especially Boomplay currently lead in Africa.

YouTube is also a lifestyle brand that connotes access to the average Nigerian/African while Audiomack has directly tapped into the converting the download market and integrating them with a powerful ‘trending’ page. TIDAL is too aloof for its connotation of ‘class’ and if it will succeed in Africa, its brand needs to be less ‘distant’ and ‘elitist.’ That perception must change.

How can Spotify compete?

Spotify can’t afford to be too cool for the African market like TIDAL, which did an impressive partnership with MTN, but has terribly failed so far with its integration.

Commendably, Spotify is already available on Android - which is a step in the right direction. But it requires more than that to truly battle in this market.

Right now, the most similar competition to Spotify is YouTube [Main/Music]. YouTube Music offers similar subscription plans to Spotify and both services offer freemium plans. Some have likened YouTube Main to Spotify Lite, but both are quite different. You can’t play YouTube Main on-the-go and on a lock screen, but you can do that on Spotify Lite.

While cosmopolitan cities like Lagos, Abuja and Port Harcourt are likely targets for Spotify, the company must take its evangelism beyond those cities. It should treat its integration and customer acquisition strategies like it’s trying to bank the unbanked in Nigeria. It must go into the depths of the country and get its hands dirty.

This must go beyond billboard ads that merely spreads awareness without leading to any real conversation. Gbedu has been on the billboard strategy for close to one year, yet its product still has little to no identity in the market. Some people even think that it’s a content platform, not a music streaming service.

Boomplay did a campus tour that quadrupled its subscriber base in under one year, Spotify needs such ingenious ideas to truly crack the market. The brand is already desirable, now it must be desirable and attainable to the Nigerian mainstream.

e.) Payment to artists and composers

Right now, a lot of Nigerian artists make little to nothing from music streaming. Besides Deezer which operates a user-centric payment system, every other platform operates a market share model that pays artists based on their overall market share over a period of time and at the point of payment.

Due to its market share/aggregation model, Spotify will pay artists a similar amount to Apple Music and Deezer, more than Audiomack, Boomplay and TIDAL Nigeria. However, it must still work through issues of paying composers [producers and songwriters] more than they currently get.

Spotify’s subscription in Africa is significantly lower than subscription outside Africa. Thus, payment to artists will be determined thus;

- Spotify would stop treating its overall global revenue as it used it and instead treat revenue on a country-based or continent-based pool, so that revenue can be adequately understood and distributed on a market-share basis.

- Spotify would still treat overall global revenue over a period of time as one big pool, convert to dollars and then create a global percentage benchmark for amount obtainable per stream and then distribute on a market share basis.

Spotify’s podcast plans

Phiona Okumu tells Pulse Nigeria reinforced Spotify’s, “Our aim is to become the number one-stop shop for the global audio experience across music, podcasting, audiobooks and more.”

While Okumu was coy about Spotify’s plans for the Nigerian podcasting industry, one can assume that it will take one of the following routes;

- Exclusive deals for Nigerian creators/influencers like it’s done with Michelle Obama and Barack Obama/Bruce Springsteen. It might be similar to what African Magic/M-Net is to Multichoice in Africa.

- Acquisition/Limited multi-year licensing of/Partnerships with popular podcasts. Right now, there is no Nigerian podcast with the cultural impact of Loose Talk Podcast and our podcast industry is still in its Alpha phase.

- Acquisition/Limited multi-year licensing of/Partnerships with popular production companies like Midas Radio by Aristokrat, which owns valuable podcasts like I Said What I Said and Listening Sessions, Visual Audio Times, which owns valuable podcasts like A Music In Time and 234 Essential while Pulse Podcast Network is due to launch.

Challenges to Spotify’s podcast Plans

Okumu’s coyness on the podcasting plans is understandable and it probably reflects the in-house worry around podcasting in Africa. First off, radio is too entrenched and easy/affordable to consume for the average Nigerian. All you have to do is turn on your radio wherever you are and listen, you don’t need the internet or additional costs for that.

During a 2019 conversation with The Breakfast Club, Label Exec and UnitedMasters Founder, Steve Stoute said, “Radio will never be obsolete, radio will just need to be consumed in different formats.”

In 2020, MPS via TurnTable Charts reported that the top five Nigerian radio stations in Lagos alone boasted a combined weekly listenership of over eight million.

In comparison, I Said What I Said, which is arguably Nigeria’s current No. 1 podcast can’t boast of 20,000 regular listeners every week.

While over 75 million Nigerians download music, over 75% of Nigerians consume radio. Over the three years, Spotify has grown its podcasting muscle with the acquisition of companies like Anchor, Parcast and Megaphone and more, while acquiring podcasts like Joe Budden [now sour], Joe Rogan, Michelle Obama and now Barack Obama and Bruce Springsteen.

The idea is for Anchor to aid creation with Megaphone aids in revenue generation and Streaming Ad Insertion (SAI). Already, the Anchor purchase is looking a little shaky, but Spotify is heavily assured to take on this battle.

Another major problem that Spotify faces is the problematic exclusive content-subscription model. Spotify is trying to convert listeners onto its platform, but except Spotify will acquire all the podcasts in the world and all the podcasting platforms, its exclusive content-subscription model will simply not work in Nigeria, except Spotify is willing to take losses for a long time.

In July 2020, Ari Lewis wrote that, “The problem with exclusivity is that it isn't scalable. Once everyone isn’t using it, it loses its utility value..”

During a recent analysis of Spotify’s podcasting plans on Vergecast, visiting host Allison Johnson says that, "Exclusive content is counter-intuitive to ads because advertisers want to reach as many people as possible..."

She says she posted a question around that to Spotify CEO, Daniel Ek during a recent conversation and he was unable to offer a solid response.

Solution

First off, Spotify will require - social - video content for successful content marketing in Nigeria.

The digital content giant will also need to evaluate its exclusive content-subscription model for podcasts in Africa like it did with subscription range for Africa. It might need to partner with some radio stations like Apple Music has done with Cool FM to get its word out.

Another avenue that Spotify could explore is the acquisition of Clubhouse or the creation of a similar feature to Clubhouse, like Facebook and Twitter have done in recent months. During a recent analysis of Spotify’s podcasting plans on Vergecast, the hosts; Nilay Patel and Allison Johnson argued that Clubhouse had started to steal podcast listeners.

Patel joked that, “When I get home, I usually listen to podcasts while I cook. Now, I check Clubhouse first to see if anything is there [laughs].”

Johnson also jokes that her boyfriend, who is a staunch podcast listener now visits Clubhouse more than she does.

With a Clubhouse-esque feature, Spotify can do/become five things;

1.) Be like a Twitch to broadcast live exclusive content from podcasters. Unlike Clubhouse, it should make its audio chat feature available to Android users and then have an automatic content retention feature. Regular podcasters who want to use this feature can then pay for it.

2.) Spotify can also charge listeners. In an article dated July 7, 2020, Ari Lewis wrote that, "Clubhouse can become a white-label solution for content creators and influencers... Think of Clubhouse as OnlyFans for creators.

“OnlyFans is already doing it with adult performers. It's estimated the company will take home $150MM - $300MM in revenue this year."

Lewis also adds that, "Tools like Cameo, OnlyFans and Clubhouse (potentially), where influencers can interact with their fans. Not just follow an influencer’s life, but be a part of their life."

3.) It could also have a freemium model for listeners, and use Megaphone/SAI to disrupt their experience with ads.

4.) This feature should be integrated into Spotify’s podcasting feature.

5.) Spotify can then operate its app like a social network, where users/subscribers have their own unique pages and followers. A Clubhouse-esque feature would enable Spotify to have stickiness and a network effect, more than the retention its app currently has.

With this feature, Spotify users can go from listening to music to dissecting the music in one fell swoop. Individual playlist launches can be scheduled and even random users can then be able to monetize their own content.

)

)

)

)

)

)

)

)

)

)

)

)

)

)