Cross-border payment solutions and virtual dollar card services in Nigeria is currently on an uptrend, while this is not a completely new thing, many Nigerians are yet to experience this digital finance evolution.

Payday is one of the few platforms that have revolutionised the fintech space and have a big influence on how financial services are carried out in the country. Despite a plethora of other competing corporations like Chipper Cash, they have really held their ground well as a king in the space.

Being one of the most used online fintech applications currently, it’s no surprise that users are leaving other platforms for payday.

That’s exactly why I brought the Payday vs others analysis post here, after making my research I’ve been able to come up with the below comparison.

● Accessibility

When it comes to Accessibility, Payday delivers good speed of use than almost other competitors in the ecosystem, it is very fast when it comes to launch time, transfer speed is very okay as well and almost all the transactions will deliver immediately unless you’re having network issues at your side.

There are still occasional network issues on other applications unlike Payday, issues like system busy have become prevalent in other fintech application of late and we hope other competitors looks into this as soon as possible.

● Features and functionalities

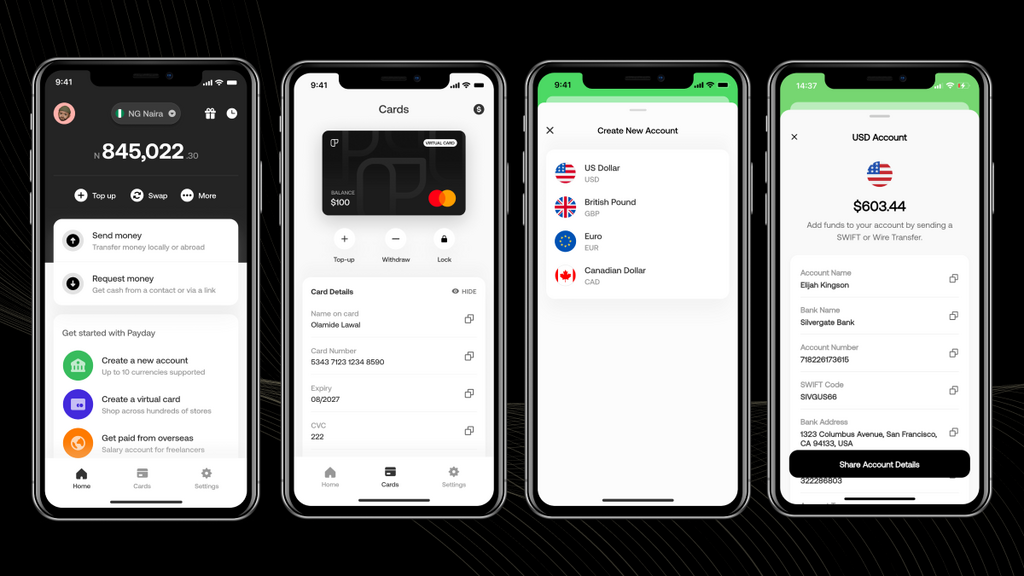

When it comes to features I give it to Payday, Payday app is one of the best, if not the best Neobank, international money transfer and virtual USD card solution in Nigeria.

What impresses me most with the app is the currency swap feature, which allows users to hold money in any currency like USD or Euros till they are ready to withdraw it without having fears of local currency fluctuating rates.

Other Payday 3:0 features include:

1. Feature to buy airtime or pay utility bills directly from the app.

2. Feature for users to add their account details to platforms like Deel to receive salaries in minutes instead of days.

3. Two new options to send and receive money through paytags and payment links via the Payday application.

4. Feature that allows users withdraw money to any Nigeria bank account

5. Virtual cards, users can create either a virtual Mastercard or visa card in minutes, the virtual dollar card works globally and at all payment checkouts with zero card creation fee and maintenance fee.

● Transaction rates and spending limit

Payday charges the cheapest rate in the market right now, even cheaper than Chipper Cash, Other platforms like Chipper Cash has a daily maximum limit of $1,000 on it's virtual card and Payday, on the other hand has no daily or monthly limit which means that users are allowed to do bigger transactions on Payday.

● User feedback and complaints

For other applications like Chipper Cash, After analysing feedback from users, the main issue seems to be about the high rates charged for transactions and the system busy error by some, it’s not funny in any way and can ruin your plans if you wanted doing a quick transaction. I hope other fintech companies in same space looks into this and try to get a solution as soon as possible.

As for Payday, there no specific pressing issues just feedback of users expressing random issues they’re facing, some about network and the rest, so even with the good ratings Payday has, there’s still enough work to be done in other to make the application more better.

Reasons to choose Payday

Why should I choose Payday over others:

● Payday is secured and trusted by thousands of users globally.

● Open an account quickly and easily using your contact information and take advantage of incredible welcome incentives.

● Manage all payments from a single app and take advantage of low transfer rate.

● Create a virtual card on the app that works globally without any limitations.

● Payday is available 24 hours a day, seven days a week.

#FeaturebyPayday

)

)

)

)

)

)

)

)